How a Tax Relief Company Works & What to Expect

- November 25, 2022

- / MC Tax Relief

- / Post Tags

Tax relief services may be crucial if you have unpaid taxes or a major tax issue. Although there are prices associated with these services, in most situations the advantages outweigh them. Tax relief services can help you avoid fines, lower your tax bill, and/or convince the IRS and/or State Agencies to stop enforcing collection activities against you. Tax professionals can also block asset seizure and wage garnishments.

The best choice frequently depends on your financial circumstances or the financial situation of the business, but here is a general description of the procedure.

Finding the Best Tax Relief Services

Finding the best tax relief company for you can occasionally be a challenge because there are so many of them. Although there are many review sites that list the top companies overall, it is impossible to rank the finest companies overall. The majority of large businesses are able to work remotely and assist taxpayers in any state who are having IRS tax issues. The businesses frequently lack state-specific experience. The business you pick truly relies on the specific tax issue you are facing. You will find it simpler to traverse the internet and find the best company for your unique situation if you use this guide to find the greatest tax relief company.

Free Tax Consultation with Tax Relief Services Evaluation

There is a free consultation to start the process. Although it often takes less time, it can also take longer. In order to determine if you may benefit from tax services, a tax expert will interview you and inquire about your financial and tax circumstances during the conversation. In most circumstances, you will be aware of your alternatives during the call. If you have a state tax issue, make sure the organization has experience working with that particular state taxation department as well because the majority of businesses and specialists expressly specialize in handling IRS tax difficulties.

After You Select a Tax Relief Firm or Tax Professional

The procedure begins with a complimentary consultation. Even while it frequently takes less time, it sometimes does. A tax professional will interview you and enquire about your financial and tax conditions in order to ascertain whether you might benefit from tax services. Most of the time during the call, you will be aware of your options. Because most firms and experts expressly concentrate on managing IRS tax issues, if you have a state tax issue, make sure the company has experience working with that specific state taxation authority as well.

Tax Resolution and Settlement Process Begins

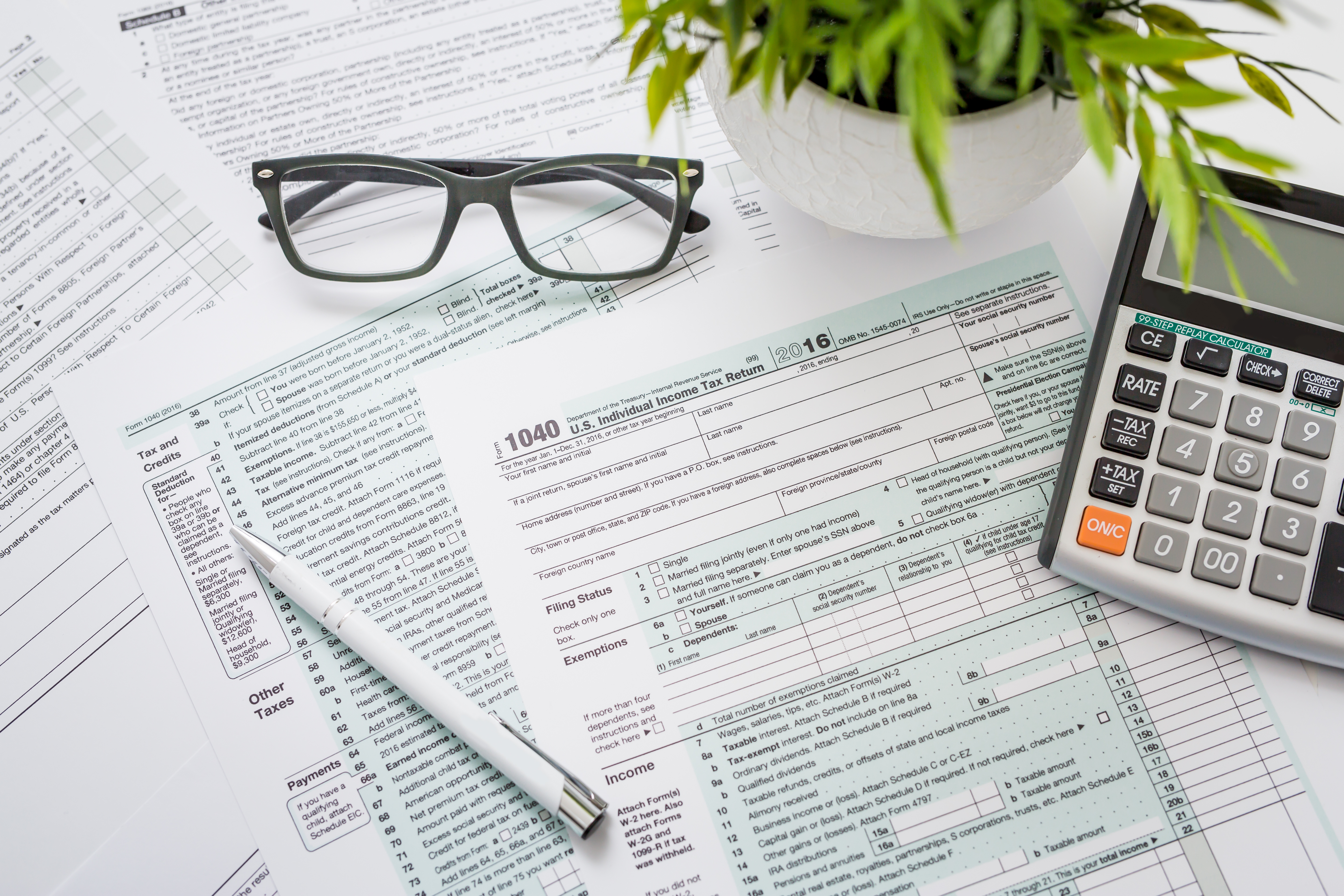

After a licensed tax specialist evaluates your transcripts and ascertains your financial condition, the company will often give you a selection of IRS programs and/or State tax programs you can pursue. A compliance check is a common name for it.

A summary of the associated fees will be provided by the tax relief company. If you accept the services and costs, the company will assign your case to a tax lawyer, registered agent, or CPA who will represent you or your company. Before representation is effective, you must sign a 2848 or Limited Power of Attorney form (POA) allowing the licensed tax professional to speak with an IRS agent or Revenue Officer directly in order to resolve your tax issues. A team of experts may occasionally collaborate on your case.

The qualified tax expert identifies the best possible tax relief strategy for your circumstances. The following are a few typical IRS solutions:

• An Installment Agreement (payment plan)

• Partial Payment Installment Agreement (PPIA)

• Hardship Status Request (Currently not Collectible)

• Offer In Compromise

• Innocent Spouse Relief

• Audit Defense

• Identity Theft Victim Assistance

Each state also offers a unique set of solutions. While many of the remedies are similar to those the IRS provides, state-specific problems will necessitate filings that are entirely different.

To balance your budget with what the IRS/State will accept is the objective. All the paperwork needed to submit an application for a settlement or payment plan is handled by your tax professional.

Although the procedure is not always speedy, at least you are headed in the correct direction if you contact a tax firm. By solving your difficulties as soon as possible, you can save money and reduce stress.

Settlement Approved and Taxpayer in Full Compliance

You make the necessary payment following the IRS's approval of the proposal. For instance, if you submitted a request for an offer in compromise and the IRS accepts it, you must pay the agreed-upon sum (generally have to wait 9-12 months). The IRS is totally off your back, but you still need to make sure that you file your taxes on time and pay your taxes on time for the next five years.

After that, you continue to be in good standing with the IRS as long as your payments are made on time and you comply with any further filing requirements. Your tax advisor will also provide you with advice on how to stay away from potential tax issues. Last but not least, the licensed tax professional will typically withdraw the POA with the IRS after you set up a resolution with the IRS and receive further guidance from them.

What to Look for in a Tax Relief Professional ?

What to Look for in a Tax Relief Professional ?

Look for Relevant Experience

Look for Relevant Experience

Get Skilled and Qualified Tax Relief Professionals

Get Skilled and Qualified Tax Relief Professionals

Seek Out Tax Relief Specialists

Seek Out Tax Relief Specialists

Find Experts with a Deep Knowledge of Tax Relief

Find Experts with a Deep Knowledge of Tax Relief

Do You Need A Tax Attorney if You Owe Back Taxes ?

Do You Need A Tax Attorney if You Owe Back Taxes ?

4 Essential Reasons to Choose a Certified Tax Resolution Specialist

4 Essential Reasons to Choose a Certified Tax Resolution Specialist