Why Doing Your Own Business Taxes or Resolving Your Own Tax Problem is a Terrible Idea

- October 5, 2021

- / MC Tax Relief

- / Post Tags

Running a business requires you to wear several hats, from office cleaner to supply buyer to customer schmoozer to payroll processor. Should you, however, add IRS tax problem solvers to your already extensive list of responsibilities? What if you have a tax dispute with the Internal Revenue Service (IRS) ? What if doing your taxes yourself causes you to have a tax problem ?

We often observe payroll and income tax problems or audit among small business clients, clients with either a schedule C, or a corporation, partnership, or LLC, simply because they perceived they would be able to do it easily on their own. It is a terrible idea.

Doing your own business taxes, even if you think you can, is a bad idea. It's far worse to try to solve your own tax problem. Here are a few reasons why you should entrust the filing of your business tax returns and the resolution of your business IRS tax problem to IRS tax problem solvers.

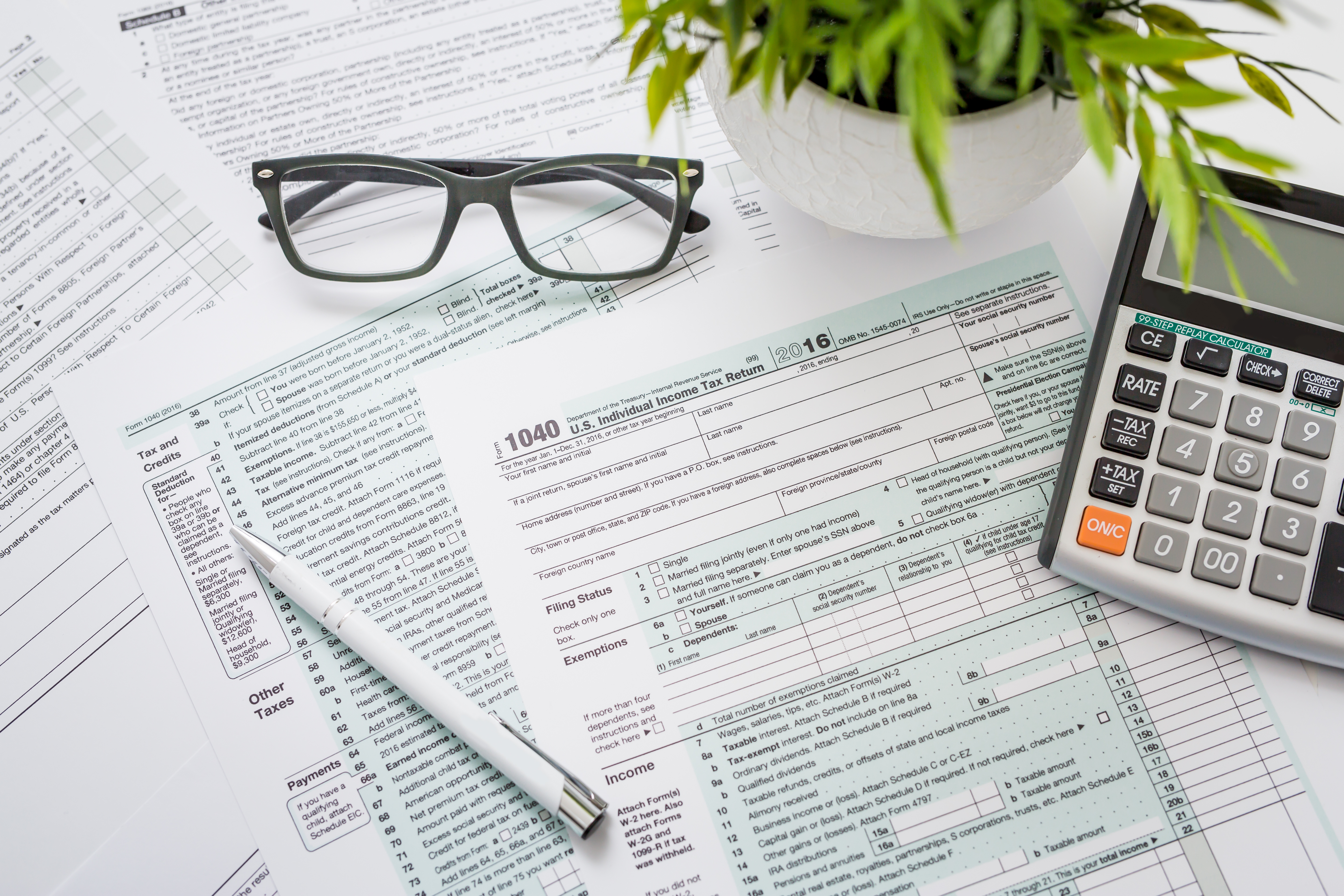

It's easy to make a mistake :

A tax return for a small business can be dozens of pages long, and many forms are considerably more complicated. With so many numbers and so much data, there are literally thousands of ways to make a mistake.

Even a minor blunder can have major ramifications for your small business, and filing your own taxes puts you at risk. At the absolute least, those oversights could result in you paying more taxes than you should, as well as fines and interest; at worst, they could trigger an audit, causing your business to be shut down for months. If you owe back taxes, the IRS can put a levy on your bank account and place a lien on your property until you pay.

Tax laws are constantly changing :

Last year, our tax rules underwent some of the most significant changes in the prior 30 years. With more words than the Bible and complexities at every turn, the tax law is already one of the most complicated books ever created. To make matters worse, those laws aren't fixed; they're constantly changing.

Even if you know everything there is to know about the present tax system, it won't last long. Every year, there is a flood of new tax law changes, many of which will have an immediate impact on your small business. If you rely solely on your own knowledge and technology resources, you risk missing a critical update that might save your company money or keep you out of IRS trouble.

In the event of an audit, you will be on your own :

The chances of being audited as an individual taxpayer are lower than 1%, while the chances of being audited as a business owner filing a schedule C are far higher. The IRS is increasingly focusing its attention on small businesses, which means you're on the IRS's radar.

Even if you do everything properly, you will almost certainly be audited at some point. If you prepare your own taxes, you may find yourself on your own when the IRS calls.

Audit defense and IRS representation are specific skills that 95% of CPAs do not possess. It is always recommended to employ reputable and professional IRS tax problem solvers like MC Tax Relief that deal with the IRS on a daily basis.

The knowledge you gain from hiring a professional is well worth the money

It might be costly to have your business taxes prepared by a professional. You could pay anything from a few hundred dollars to several thousand dollars to have the job done, depending on the size and complexity of the return.

It's difficult enough to run a small company. The last thing you want to do is add extra responsibilities to an already overburdened schedule or get into tax issues. If you're still doing your own business tax returns, it might be time to hand off this important job to a reputable IRS tax problem solver.

Even if you have years of unfiled tax returns, MC Tax Relief specializes in tax resolution. Reach out to us today for a no-obligation private consultation with a highly experienced tax resolution specialist who knows how to navigate through the IRS maze. We'll discuss your choices for permanently resolving your tax problem.

What to Look for in a Tax Relief Professional ?

What to Look for in a Tax Relief Professional ?

Look for Relevant Experience

Look for Relevant Experience

Get Skilled and Qualified Tax Relief Professionals

Get Skilled and Qualified Tax Relief Professionals

Seek Out Tax Relief Specialists

Seek Out Tax Relief Specialists

Find Experts with a Deep Knowledge of Tax Relief

Find Experts with a Deep Knowledge of Tax Relief

Do You Need A Tax Attorney if You Owe Back Taxes ?

Do You Need A Tax Attorney if You Owe Back Taxes ?

4 Essential Reasons to Choose a Certified Tax Resolution Specialist

4 Essential Reasons to Choose a Certified Tax Resolution Specialist