What Is IRS Form 8300 And How It Work ?

- May 12, 2022

- / Author Name

- / IRS tax problem solvers,tax problem help,tax relief company

Looking for the best IRS tax problem solvers to know the details of IRS Form 8300? Then, you’ve reached the right platform to get a clear idea about it. After a post-pandemic situation, a number of tax relief company is appointed to cope up with every citizen’s tax return situation with extra care. They further have to handle each incentive payment of clients.

The IRS Form 8300 isn’t only about stimulus payments, and also it involves new streams of side income, advanced tax credits, self-employment taxes, unemployment benefit taxes, and several rules that are upgraded as well. If you are running a venture and received a good amount of incentive, make sure to report your income accurately to avail of the benefits. This means you should know everything about IRS Form 8300 for today’s business.

Keep on reading to explore everything about filing IRS Form 8300 that the leading IRS tax problem solvers can assist you to enjoy its advantages.

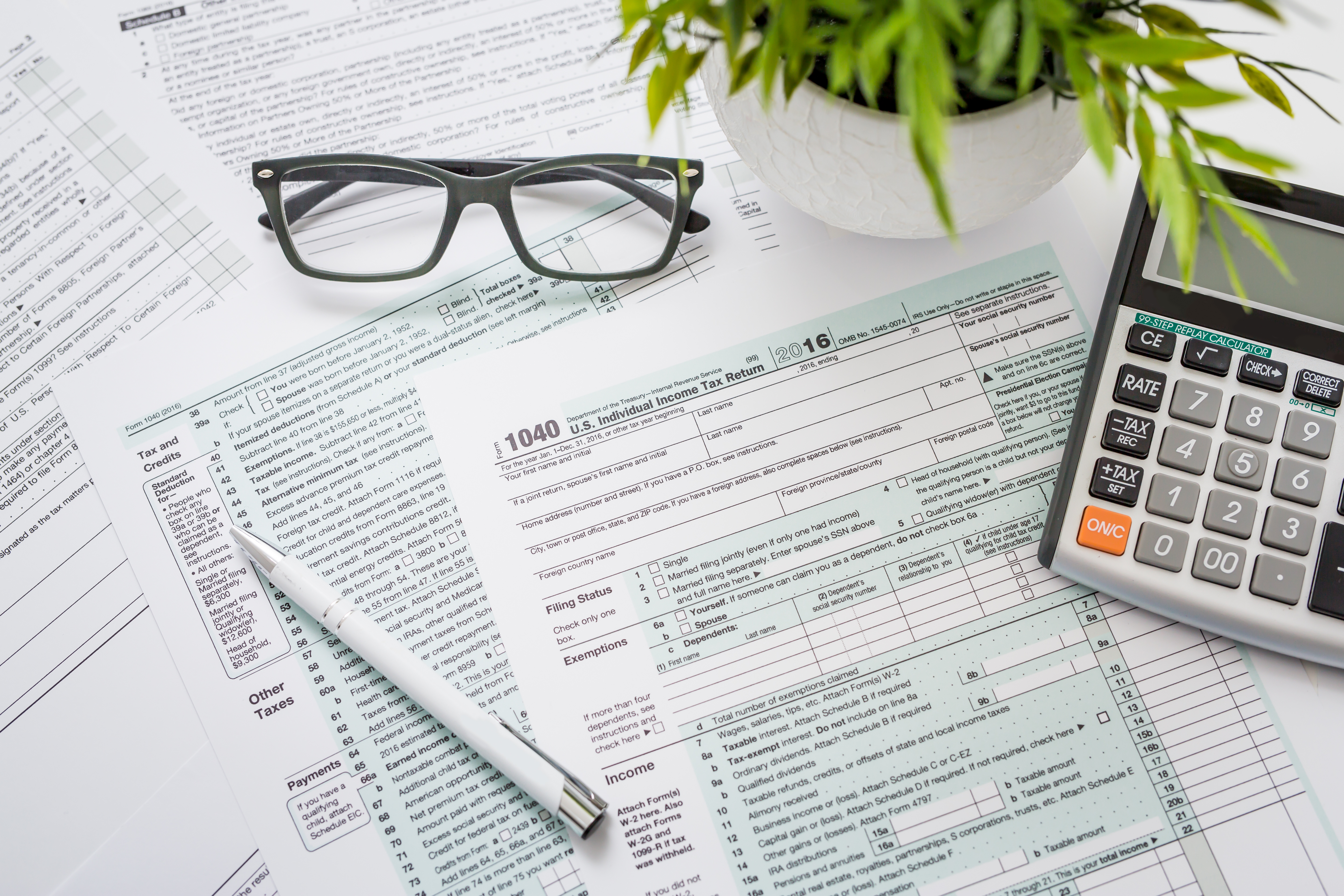

What Is IRS Form 8300?

At the basic level, IRS Form 8300 is an official report stating you’ve received a cash amount as an incentive payment. There are multiple reasons to get awarded with such a cash payment, which include –

• Pre-Existing Debt Payments

• The Sale of Real Property

• Making/ Repaying A Loan

• Rental of Personal/ Real Property

• Reimbursement of Expenses

• Sales of Products/ Services

This form further dictates you to report multiple payments within a year, which exceeds your payment received in cash. In the IRS Form 8300, there’s an instruction on cash payments, which also includes traveler’s checks, bank drafts, cashier’s checks, and money orders. You also need to ensure filing the form within 15 days of receiving any cash payment over $10000. For the best tax problem help, you are recommended to consult an expert and get exact solutions to all your problems.

How To File Tax Form 8300?

If you are well-versed with online tax filing, look for filing IRS Form 8300 for businesses completely electronically to perform your jobs timely. To do an e-filing of Form 8300 that’s totally free, you need to complete the form in a single seating. If you want to pick other ways, you simply need to take a printout of the form and direct mail it to the IRS. It’s important to keep copies of all transactions of what you have filed, irrespective of whether you’ve mailed your form or filed it online.

In case you have failed to file IRS Form 8300, look for the best IRS tax problem solvers to reduce your penalties. Because under some unique conditions, you can even request a penalty reduction, which will renounce all your penalties. So, finding the best tax problem solvers can enable you to manage a range of tax-based troubles.

In case you are charged with a plenty of penalties, you might consider it as an unwanted situation, which requires expertise to manage efficiently. There is a range of tax relief solutions to explore allowing you to reduce or eliminate most of the tax debts for businesses. It's time to discuss with an expert if you are eager to explore more about such potential solutions.

Now that you are in search of the top-ranked tax relief company to help your find fast relief, you are recommended to hire the dedicated team of MC Tax Relief for the best help. Helping to protect all of our clients with a range of tax-related problems, you can anytime come to our office if you want or simply give us a call at (855) 540-0850 today for a discussion with the leading IRS tax problem solvers!

What to Look for in a Tax Relief Professional ?

What to Look for in a Tax Relief Professional ?

Look for Relevant Experience

Look for Relevant Experience

Get Skilled and Qualified Tax Relief Professionals

Get Skilled and Qualified Tax Relief Professionals

Seek Out Tax Relief Specialists

Seek Out Tax Relief Specialists

Find Experts with a Deep Knowledge of Tax Relief

Find Experts with a Deep Knowledge of Tax Relief

Do You Need A Tax Attorney if You Owe Back Taxes ?

Do You Need A Tax Attorney if You Owe Back Taxes ?

4 Essential Reasons to Choose a Certified Tax Resolution Specialist

4 Essential Reasons to Choose a Certified Tax Resolution Specialist