Tax Relief Solutions : How to Find the Right One for You

- May 25, 2022

- / Author Name

- / Post Tags

You don't have to live with a tax problem indefinitely. The IRS offers a variety of choices for taxpayers to settle tax debt, but it's critical to understand what's available before deciding how to proceed. You can contact MC Tax Relief for any tax problem help. Here's how to figure out which tax relief option is best for you.

How do you qualify for tax relief ?

Because you're a taxpayer, you're eligible for one of the IRS's tax relief programs, but you'll need to research the many options to see which one best suits your circumstances. People who are unable to pay or submit taxes due to diseases or natural catastrophes may be eligible for assistance. In addition, the IRS offers tax help to persons who are having trouble paying their obligations.

You'll have to ask for the precise form of tax relief that corresponds to your case. The IRS will assess your ability to pay, your income, your expenses, and your assets when you apply.

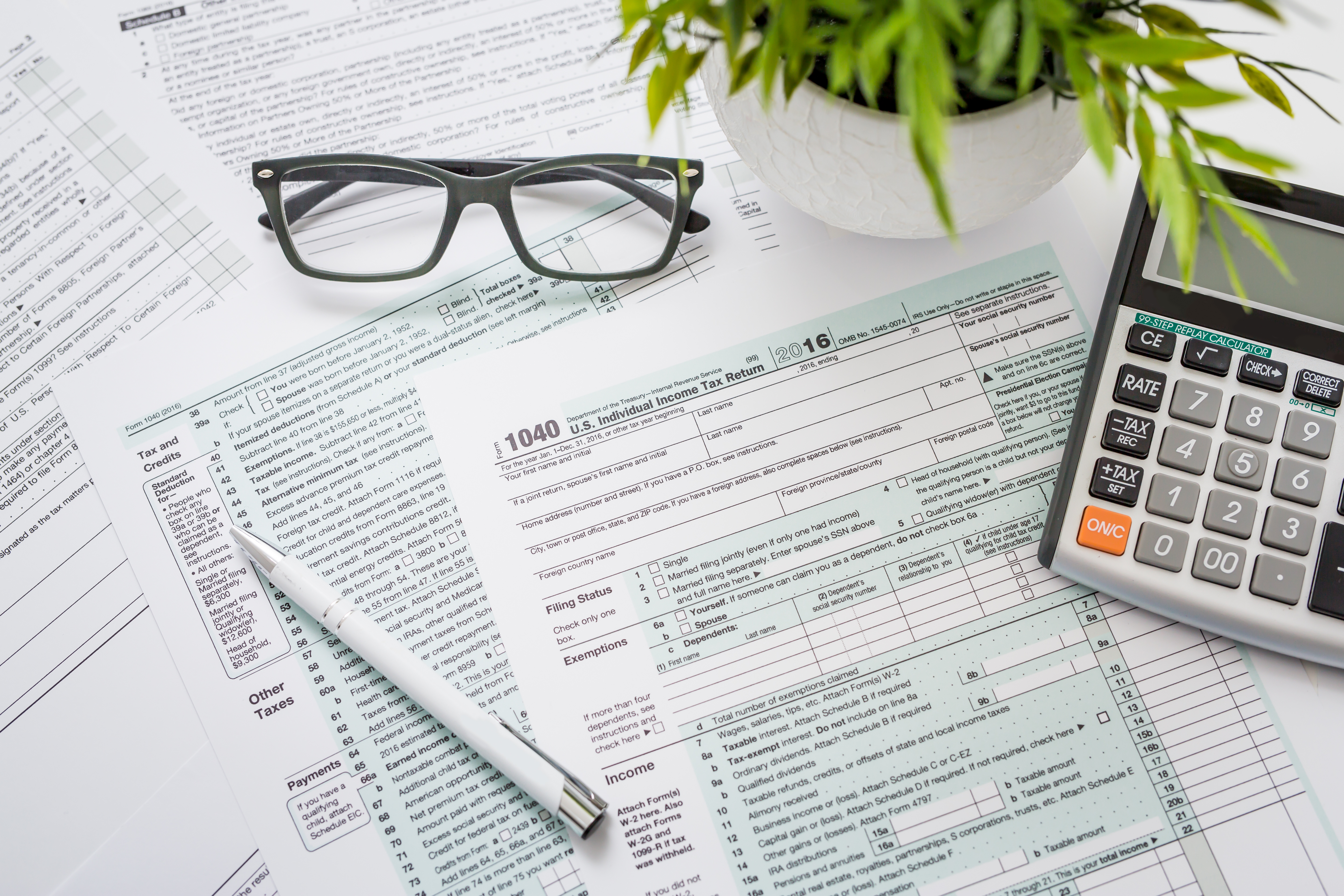

How do tax relief services work ?

Relief does not always imply that your debt will be forgiven, but the IRS may be fairly accommodating when it comes to ensuring that you can manage your tax burden. Based on the financial information you provide; the IRS will determine your capacity to pay what you owe.

There's a chance the IRS will settle your debt for a fraction of what you owe. Furthermore, if you can demonstrate financial difficulty, your need to repay your debt may be deferred. The IRS may also offer you a payment plan that lets you repay what you owe over a six-year period with lesser installments.

What are some tax relief options you can consider ?

The Internal Revenue Service (IRS) provides a variety of tax relief choices. You'll have to research each choice to see which one best fits your needs. The following is a list of possible possibilities for you:

• Offer in Compromise (OIC)

• Installment Agreement (IA)

• Currently Non Collectible (CNC)

• Penalty Abatement

• Audit Appeal

• Innocent Spouse Relief

• Fresh Start Initiative

Keep in mind that if your tax returns are beyond due, the IRS will not consider you for any of its relief choices.

The good news is that the IRS just wants you to submit any outstanding taxes, and the fact that you did so late will have no impact on your eligibility for any tax relief options. Of course, if you want to prevent future tax problems, you should file those late returns as soon as possible.

How Can You Tell Which Tax Relief Option Is Best for You ?

The majority of consumers are unaware of the IRS's relief choices. That's why, while determining which program is best for you, you should get advice from tax professionals. Working with a tax firm that routinely interacts with the IRS helps guarantee that you take the proper measures and prevent further fines. Taking steps to eliminate interest and penalties is one of the most significant things a tax expert can do for you. Tax levies, tax liens, and wage garnishments are examples of severe penalties.

The majority of taxpayers who owe money qualify for Installment Agreements since the requirements are simple. All you have to do is agree to provide the IRS with financial facts proving that you don't have the cash or borrowing ability to pay down your debt right now. If you can show that paying down your whole debt would cause financial hardship, you may be eligible for a more powerful relief option like Offer in Compromise or Currently Non Collectible.

MC Tax Relief can assist you in determining your relief options

Certified tax resolution specialists at MC Tax Relief assists can help you in obtaining tax relief options that can completely transform your life. Allow us to take you through the alternatives accessible to you, and we'll make sure you're following the IRS's rules so the procedure goes as easily as possible. We'll also assist you in getting set up so that your payback procedure goes smoothly. We have a staff of qualified tax experts, CPAs, and attorneys ready to devote time and effort to your case. Call us right now!

What to Look for in a Tax Relief Professional ?

What to Look for in a Tax Relief Professional ?

Look for Relevant Experience

Look for Relevant Experience

Get Skilled and Qualified Tax Relief Professionals

Get Skilled and Qualified Tax Relief Professionals

Seek Out Tax Relief Specialists

Seek Out Tax Relief Specialists

Find Experts with a Deep Knowledge of Tax Relief

Find Experts with a Deep Knowledge of Tax Relief

Do You Need A Tax Attorney if You Owe Back Taxes ?

Do You Need A Tax Attorney if You Owe Back Taxes ?

4 Essential Reasons to Choose a Certified Tax Resolution Specialist

4 Essential Reasons to Choose a Certified Tax Resolution Specialist