4 Common Mistakes Taxpayers Make When Applying for the IRS New Start

- September 6, 2021

- / MC Tax Relief

- / tax problem solvers,IRS tax problem

Once you've confirmed your eligibility for the IRS Fresh Start Program, you'll want to engage with a reputable tax problem solver to guide you through the application process. A single filing error might mean the difference between getting the help you need and owing the IRS the full amount you owe.

What are the consequences of making application mistakes ?

The short answer is that applying for the IRS Fresh Start Program carries a lot of risks. You may not only be denied relief, but you may also prolong the statute of limitations (SOL) on your tax liability's expiration date in an unfavorable fashion.

You're probably eager to get over your IRS tax problems, but here is your second chance to make things right. Everything must be flawless. Before you apply, go over the requirements that must be in place after you've determined your eligibility. These are some of them:

• All of your tax returns have been submitted.

• Keeping track of expected taxes

• Not being audited on a regular basis

• Having a tax liability that has been assessed

If you file without meeting any of these requirements, you will be automatically rejected from the program. Keep in mind that by submitting an application, you may give the IRS more time to collect on your debt for as long as it takes for the application to be evaluated and granted or denied. This period could last anywhere from a few months to several years. You could make it much longer if you make a mistake and have to resubmit.

Here are some of the common mistakes that Individuals make when applying for the IRS Fresh Start Program :

Mistakes are inevitable, but they cannot occur here. Every year, deserving people are turned down by the Fresh Start Program because the process was more challenging than they imagined.

Adding another charge may not be at the top of your to-do list if you correctly waited for your outstanding balance to be assessed — but engaging a tax problem solver is an investment in obtaining a favorable outcome against the IRS tax problem.

Here are some of the most common mistakes we see :

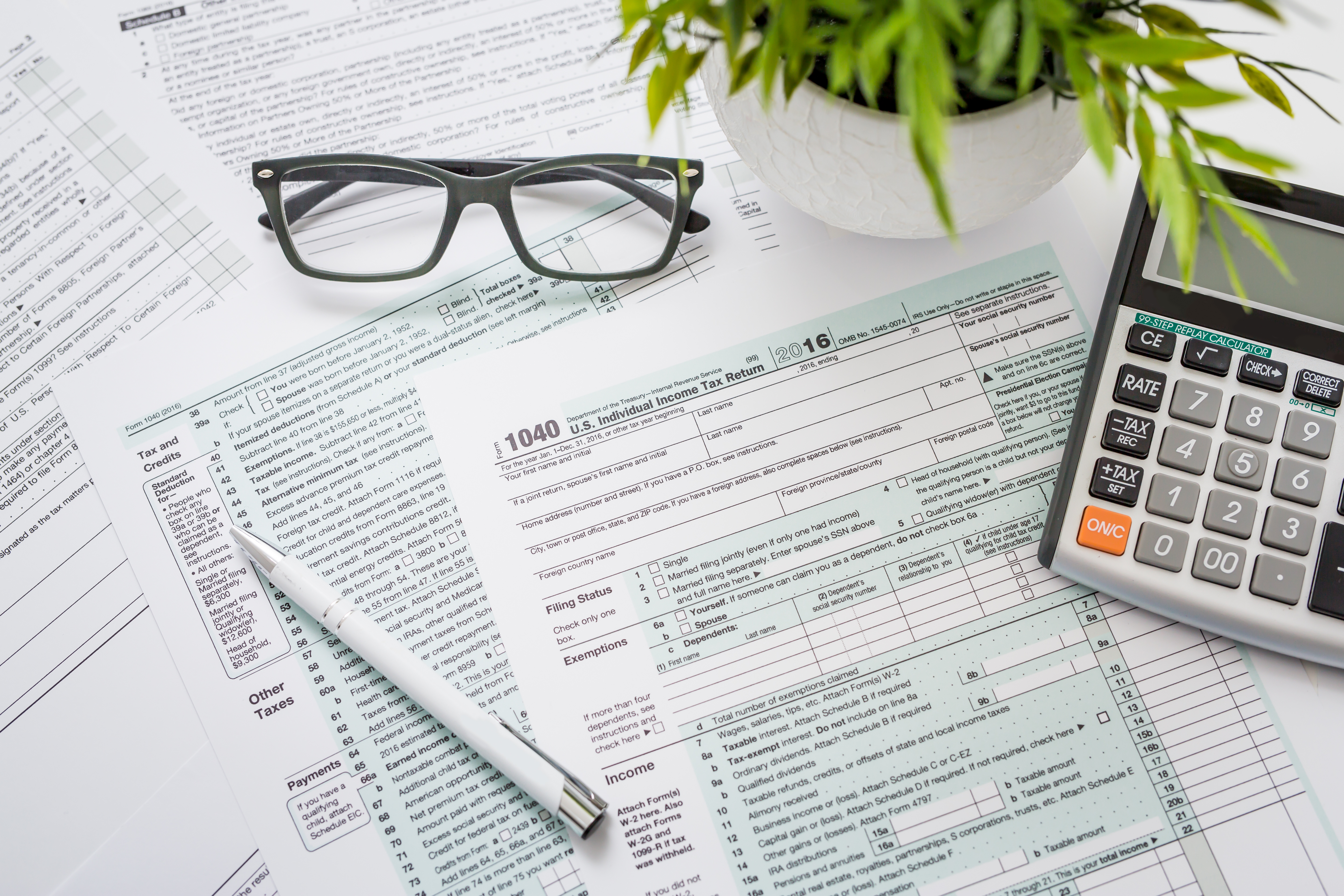

- Not taking advantage of all breaks : When applying for the Fresh Start Program , it's vital to know what counts as a break and what doesn't. Every opportunity for a break should be taken.

- In the case of a personal financial situation, there is no proof of hardship : Tax problem solver know how to present a financial hardship case to the IRS.

- Having insufficient documentation : The importance of providing the correct documentation in the correct locations is critical to the application process.

- Lying to the IRS : Your application will be automatically excluded from consideration as a result of this. If you are discovered to be dishonest, don't expect the IRS to treat you well.

Being dishonest or not completely forthcoming with all your information is a major offense. Examples of this are feigning hardship or hiding assets (like a property or timeshare). Do not lie to the IRS. If you do, a tax professional might not be able to assist you.

For assistance, contact tax problem solvers

We've said it before, and we'll say it again : You only get one chance to put things right with the IRS, so don't waste it.

The assurance of knowing that your application has been reviewed by a tax specialist should motivate you to pursue your application.

MC Tax Relief has extensive experience filing offers-in-compromise, establishing installment agreements, and navigating the IRS Fresh Start Program. We deal with the IRS on behalf of our clients every day, and we'd be pleased to do the same for you so you don't have to.

What to Look for in a Tax Relief Professional ?

What to Look for in a Tax Relief Professional ?

Look for Relevant Experience

Look for Relevant Experience

Get Skilled and Qualified Tax Relief Professionals

Get Skilled and Qualified Tax Relief Professionals

Seek Out Tax Relief Specialists

Seek Out Tax Relief Specialists

Find Experts with a Deep Knowledge of Tax Relief

Find Experts with a Deep Knowledge of Tax Relief

Do You Need A Tax Attorney if You Owe Back Taxes ?

Do You Need A Tax Attorney if You Owe Back Taxes ?

4 Essential Reasons to Choose a Certified Tax Resolution Specialist

4 Essential Reasons to Choose a Certified Tax Resolution Specialist